The Microsoft Dynamics 365 extension

for the transmission of tax data to ELSTER

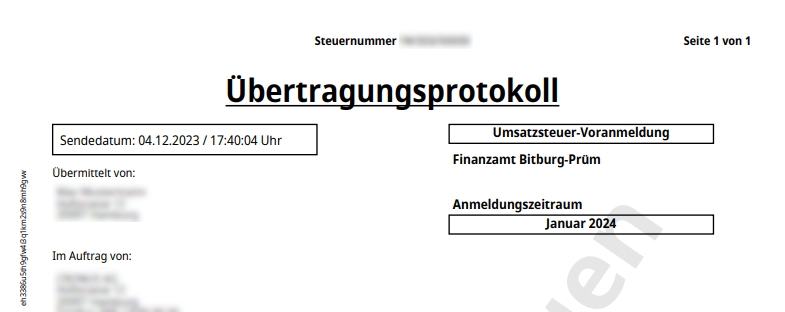

Calculate and transfer your tax data to ELSTER with just one click

and immediately receive your transfer protocol and transfer ID to prove the transfer.

Advance VAT return

VAT return

Recapitulative Statement

Request for an extension of time

Permanent request for extension of time (including the registration of special advance payment)

One-Stop-Shop (OSS)

Quickly prepare & submit tax data

In just a few steps you can prepare and submit your advance VAT return, recapitulative statement and VAT return and apply for extensions of the deadline.

Encrypted & certificate-based transmission

Your data will be transmitted SSL-encrypted and certificate-secured via the official ELSTER Rich Client Library.

Cost-effective, transaction-based billing

With our ELSTER tax data transmission, you only pay for successful tax data transmissions. No set-up fees or maintenance costs.

Our pricing

Company

per company

30.00 € / month

incl. 5 submissions

Components

- 30 days free trial

- No contract duration

- 5 submissions per month

- Advance VAT return

- Recapitulative Statement

- Permanent request for extension of time

- VAT return

- Request for an extension of time

- One-Stop-Shop (OSS)

Extras

- Additional submissions 10.00 € each

Support

- Email support within 24 hours

Tenant

per tenant or on-premises environment

100.00 € / month

incl. 25 submissions

Components

- 30 days free trial

- No contract duration

- 25 submissions per month

- Advance VAT return

- Recapitulative Statement

- Permanent request for extension of time

- VAT return

- Request for an extension of time

- One-Stop-Shop (OSS)

Extras

- Additional submissions 10.00 € each

Support

- Email support within 24 hours

Individual solutions for large companies

For corporate customers with individual requirements, we are happy to provide a customized offer.

More room for your business

Reduce manual effort

Thanks to the intuitive and fast operation of the 365 business ERiC extension, your employees prepare and transmit all tax data to the tax office in the shortest possible time. This leaves more time for important tasks.

Cost-effective billing model

With us, you only pay for successful transmissions and have no additional costs such as setup fees, monthly fees or maintenance costs.

Cloud and On-Premise solution

You decide: Use our 365 business PDF extension as SaaS in the cloud or as a self-operated on-premise solution in your company's network.

Secure data transmission

Wir übermitteln Ihre Daten SSL-verschlüsselt und zertifikatsbasiert über die offizielle ELSTER Rich Client Bibliothek. So kommen Ihre Daten sicher an. Das Übertragungsprotokoll und die Transfer-ID bestätigen die erfolgreiche Übertragung.

All ELSTER tax data in one place

Mit der 365 business ERiC Erweiterung verwalten Sie alle Ihre Steuerdaten direkt in Microsoft Dynamics 365 Business Central. Es ist kein Wechsel mehr zu ELSTER notwendig.

Personal support

In case of queries, we offer you competent and personal help via e-mail. Our experts will get back to you within a maximum of 72 hours.

Service & Support

Product updates

365 business ERiC Update 2024

Christoph Krieg

4. December 2023

Do you have any questions about our services or

do you need support for your project?

I look forward to hearing from you!